Understanding the Power of Business Credit Builder

As a business owner, you are always looking for ways to strengthen and grow your company. One often overlooked but crucial aspect of business growth is establishing a solid credit foundation through a BUSINESS CREDIT BUILDER program. In this article, we will explore the benefits, details, and frequently asked questions about Business Credit Builder, and why it is essential for the success of your business.

The Benefits of Business Credit Builder

Business Credit Builder accounts can provide your company with the financial flexibility it needs to thrive. By establishing a business credit profile separate from your personal credit, you can access higher credit limits, better terms on loans, and additional funding options. This can help your business weather financial challenges and take advantage of growth opportunities.

A Detailed Explanation

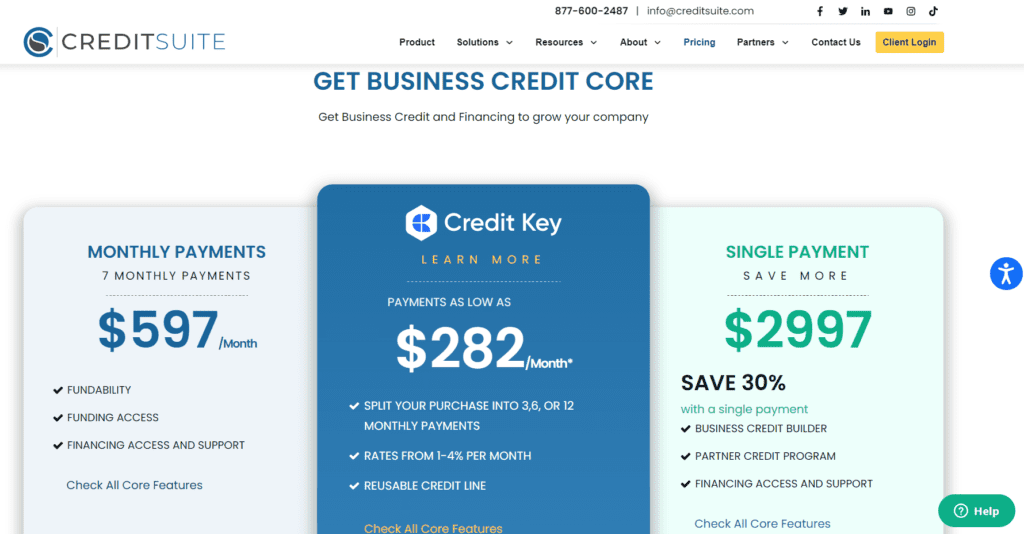

A business credit builder program is designed to help businesses build and strengthen their credit profiles. This typically involves opening a business credit builder card, securing business credit builder loans, and working with reputable business credit builder companies to add tradelines to your credit report. These services are designed to help establish a positive credit history for your business, which can lead to improved access to financing and better terms on future loans.

Frequently Asked Questions

1. What is the difference between personal and business credit?

Personal credit is tied to an individual’s social security number, while business credit is linked to a company’s employer identification number (EIN). Establishing business credit can help protect your personal assets and create a more professional image for your company.

2. How long does it take to build business credit?

The time it takes to build business credit can vary depending on various factors, such as the number of tradelines you have, your payment history, and the types of credit accounts you use. On average, it can take six months to a year to establish a solid business credit profile.

3. Can I get a BUSINESS CREDIT BUILDER card with bad credit?

While some business credit builder programs may require a minimum credit score, there are options available for business owners with less-than-perfect credit. Working with a reputable business credit building service can help you navigate the process and find a solution that suits your needs.

4. How can business credit builder loans benefit my company?

business credit builder loans can provide your company with the capital it needs to invest in growth opportunities, purchase equipment, or cover unexpected expenses. By establishing a positive payment history on these loans, you can strengthen your business credit profile over time.

5. What are some reputable business credit builders reviews?

When researching business credit builder companies, look for reviews and testimonials from other business owners who have used their services. Online platforms like Trustpilot or the Better Business Bureau can also provide insights into the reputation and reliability of different business credit building services.

Conclusion

Building and maintaining a strong business credit profile is essential for the long-term success and financial health of your company. By leveraging the services of a BUSINESS CREDIT BUILDER program, you can establish a solid credit foundation, access better financing options, and position your business for growth. Take the necessary steps today to secure a brighter financial future for your business.